What South Africa’s 2024 Life Insurance Claims Reveal About Our Health Landscape

- Albert Johnson

- Jun 5, 2025

- 4 min read

2024 Insurance claims by Liberty Discovery life and Sanlam.

Each year, the release of claim statistics by major South African life insurers offers more than just numbers—it paints a picture of the country’s evolving health challenges and underscores the value of adequate life and disability cover. During 2024, Liberty, Sanlam, and Discovery Life released their claims data for the 2024, revealing noteworthy patterns, shared health risks, and some concerning trends.

Liberty: Cancer, Cardiovascular Disease, and a Sharp Rise in Mental Health Claims

Liberty paid out a total of R7.51 billion in claims from their flagship Lifestyle Protector policy, to approximately 28 889 individuals. The personal risk claims revealed a 11.8% increase year on year. A striking feature of their 2024 claims report was:

Cancer: Accounted for 31.2% of all claims, with a higher occurrence in women (37.2%) than in men (27.09%).

Cardiovascular conditions: Made up 22.3% of claims, highlighting lifestyle-related illness as a key factor. Claims from women (14.5%) and in men (26.8%)

Respiratory diseases 5.8% musculoskeletal disorders 5.5

Cancer is he one leading cause of claims, highlighting the necessity for regular screenings to identify potential health issues before symptoms arise.

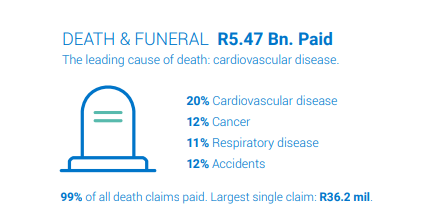

Sanlam saw a sharp increase in Death and funeral claims

Sanlam paid out over R6.62 billion in total claims, with significant insights related to age demographics:

Death and funeral claims paid out amounted to R5.47 billion, of which cardiovascular conditions made up 20% of all death claims followed by 17% of disability claims.

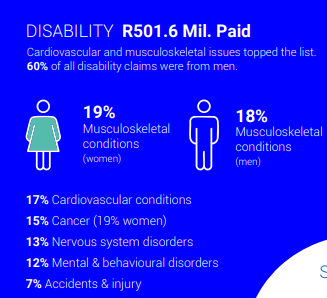

R501.6 million in disability and income protection (sickness and disability) claims

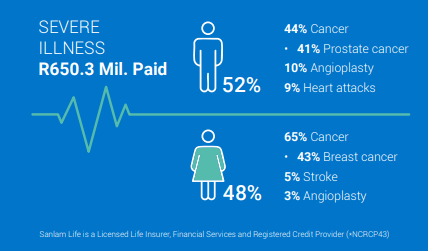

Critical illness claims amounted to R650.3 million

Leading claim conditions were:

Cardiovascular conditions (20%)

Cancer (54%) of all critical illness claims, up 30% year on year,

Respiratory illnesses (12%)

Prostate Cancer claims doubled and breast cancer claims in women increased by 33%

Rhoderic Nel, Sanlam Risk and Savings Chief Executive said:

“Currently about 24% of all living benefit claims are from clients younger than 35 years old, with increases being seen in income protection claims (up from 15% in 2022 to around 25% in 2024). It’s a sobering reminder that life-changing illness can strike at any age. Being financially prepared isn’t something to delay – it’s something to start now.”

Discovery Life: High Incidence of Multiple and Ancillary Claims

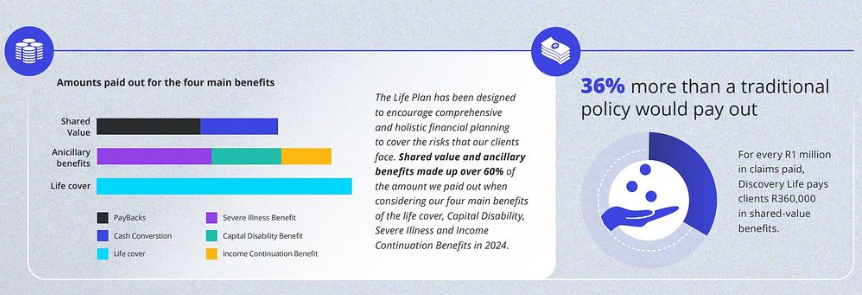

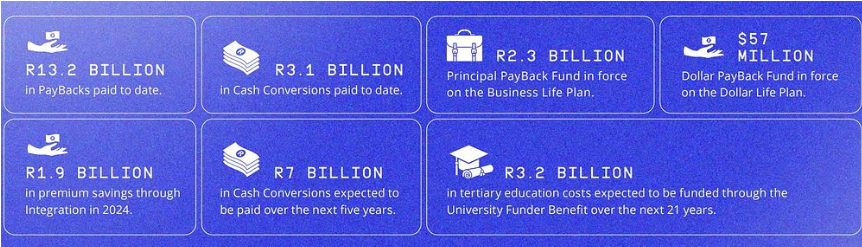

Discovery Life paid out R11.5 billion in claims during 2024, of which it must be noted that R6.85 billion in individual life insurance claims, R2.4 billion in Shared-Value payments (rewards for healthy behaviors) and R2.3 billion in Group Risk claims.

Some Statistics:

51% of the total claims were paid for ancillary benefits such as severe illness, disability, and income continuation.

Severe illness benefits alone amounted to R1.5 billion, then R933 million for Capital Disability benefits, and R673 million for Income Continuation benefits

Death claims were R3.4 billion

Shared Value benefits to the value of R2.4 billion were paid out, comprising of:

R1.4 billion in Paybacks,

R1 billion in Cash Conversions

Cancer dominated claims, which was the leading cause of death in women (35%)

Cancer was also the most common cause of disability among men (30%) and women (34%)

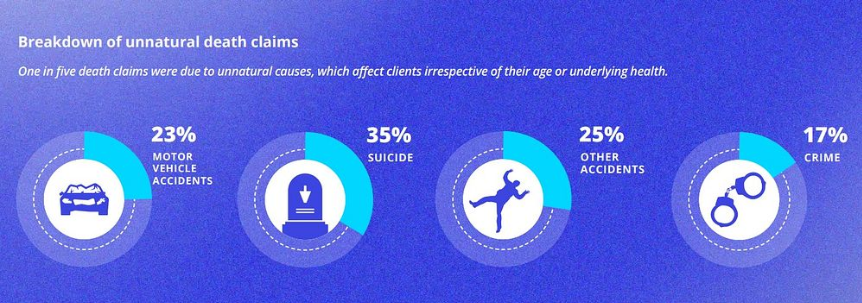

A breakdown of unnatural death claims:

23% of Motor vehicle accidents

35% Suicide

25% other accidents

17% from Crime

Discovery’s data highlights that their shared value system is working, and that policy holders engaging in the systems are being incentivized by working with the benefits.

Where the Trends Correlate: Shared Health Risks Across Insurers

When comparing the 2024 claims reports from these three insurers, some powerful commonalities emerge:

1. Cancer Remains the Top Cause of Claims

Across all three providers, cancer featured prominently as a leading condition—whether in critical illness claims, income protection, or disability. This highlights the ongoing need for early detection, and to go for screenings. There is a tremendous impact of long-term treatment.

2. Cardiovascular Disease Is Rising in Younger Populations

Both Liberty and Sanlam ranked cardiovascular issues among their top claims, even in policyholders under 45. This points to lifestyle factors—diet, stress, lack of exercise—as major contributors.

3. Mental Health Is Becoming a Leading Risk

All three insurers noted a sharp increase in mental health-related claims, including suicide, psychiatric illness, and neurological conditions.

4. Claims Are Increasing Among Younger Policyholders

The insurers data emphasized a significant number of claims coming from clients under the age of 45—a demographic traditionally considered lower-risk. This signals the need for early financial planning and comprehensive cover from a younger age.

Time to Rethink Cover considering Real-Life Claims Data

The 2024 claims statistics show that health risks are becoming more complex, more chronic, and increasingly common at younger ages. While many South Africans still think of life insurance as a benefit for “later in life,” these figures prove that serious illness, disability, and mental health concerns are affecting people in their 20s, 30s, and 40s.

Whether it’s upgrading critical illness cover, adding income protection, or ensuring your policies allow for multiple claims, the message is clear: your cover needs to match today’s realities, not yesterday’s assumptions.

If you haven’t reviewed your portfolio recently, now is the time to have that conversation. We can help you assess whether your current policies are aligned with the risks being paid out in the real world.

Comments