Surge in Suicide-Related Life Insurance Claims Highlights Mental Health Crisis

- Apr 11, 2025

- 4 min read

Updated: Apr 24, 2025

In a sobering reflection of South Africa’s deepening mental health crisis, suicide-related life insurance claims surged by 62% in 2024 compared to the average of the previous five years. This insight was revealed during a recent Discovery Life webinar discussing the company’s 2024 claims data.

The insurer paid out an astounding R9.1 billion in life, disability, and illness claims last year. Life cover remained the largest portion, exceeding R3.4 billion, followed by severe illness benefits (R1.54bn) and capital disability benefits (R933m). Other notable payouts included income continuation (R673m) and health plan protection (R133m).

Mental Health Crisis: Suicide Leading Unnatural Deaths

One of the most distressing statistics was that one in five death claims stemmed from unnatural causes—with suicide accounting for 35%, surpassing even motor vehicle accidents (23%) and crime (17%). Among individuals aged 41 to 60, suicide made up an alarming 45% of unnatural death claims.

Dr. Maritha van der Walt, Chief Medical Officer at Discovery Life, described the trend as “very sad and concerning.” She noted that the majority of these cases involved older men. The youngest reported was a 35-year-old female medical professional with pre-existing psychiatric conditions.

“Sixty-three percent of these claimants were diagnosed with mental health conditions like depression, anxiety, and bipolar disorder,” Van der Walt explained.

She also emphasized how financial pressures, particularly in the wake of COVID-19, are likely contributing factors—especially for older adults who’ve experienced job loss or economic instability. Despite the sobering numbers, Van der Walt offered a hopeful reminder: “Depression is treatable.” She advocated for a holistic care approach, including medication, psychological support, and community-based interventions.

Emerging technologies like pharmacogenomics may also help personalize treatment by identifying which medications are most likely to be effective.

Cancer Continues to Be a Major Health Threat

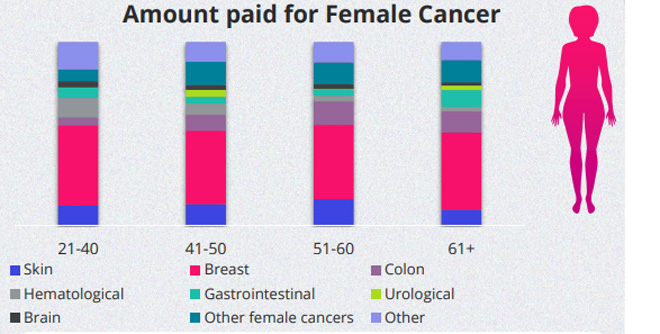

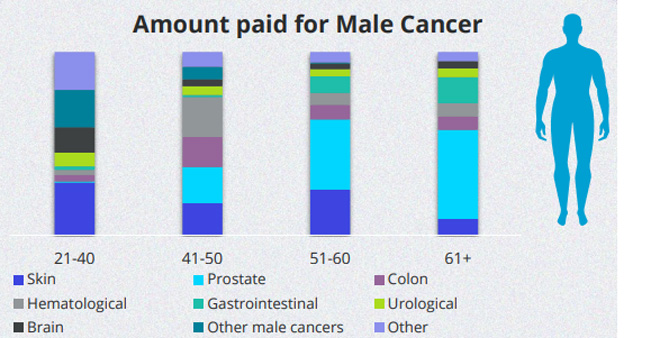

Beyond mental health, cancer remained a dominant cause of claims across Discovery Life’s policyholders. It was the leading cause of severe illness, disability, and death among women.

Melanoma, in particular, emerged as a major concern—ranking third in Discovery’s severe illness claims. It affects people of all ages, from teenagers to seniors, and early diagnosis remains key. Discovery’s early cancer benefit covers melanoma in situ, offering a better prognosis with early treatment.

“Watch out for moles that change in size, shape, or color—or begin bleeding,” Van der Walt warned.

Encouragingly, better screening efforts are leading to earlier cancer detection. Since 2020, there’s been a 62% increase in early-stage cancer claims. Mammogram screenings are up 14%, prostate exams are 19% higher, and colorectal screenings have climbed 29%.

This uptick in early diagnosis has led to a 16% drop in Stage 4 cancer-related disability claims, proving that preventive healthcare can significantly impact outcomes.

Disability and Income Protection: Vital at Every Age

Cancer was also the top cause of disability claims in 2024, followed by nervous system conditions like strokes. Discovery Life’s Income Continuation Benefit paid out R673 million in 2024, with another R3.4 billion projected for current claimants over time.

Musculoskeletal conditions were the most common reason for income claims—particularly back, joint, and muscular issues—affecting 38% of male and 28% of female claimants. Aging correlates strongly with long-term disability. Discovery data showed that 30% of claimants were permanently disabled, and these individuals made up 71% of the total payout value:

Under 30: 19% permanent

Ages 31–40: 25% permanent

Ages 41–50: 34% permanent

Ages 51–60: 37% permanent

Over 60: 24% permanent

Preparing for Illness Later in Life

Discovery also paid R128 million in claims for its Converted Severe Illness Benefit, which activates when a disability cover ends—ensuring clients stay protected into older age.

Deputy CEO Gareth Friedlander emphasized the importance of securing cover while young.

“A significant 28% of our severe illness claims now come from clients over 60. That’s up from just 11% a decade ago,” he noted.

Given that older adults often face challenges accessing or affording coverage later in life, early planning is critical.

The Importance of Early Intervention

Given the high stakes of mental health and critical illnesses, early intervention is key. It’s essential to address mental health issues before they escalate into crises. This can involve seeking therapy, engaging in community support, or using mobile health applications that promote mental well-being.

Healthcare providers should prioritize regular screenings for both mental health and physical conditions. Awareness campaigns could help educate the public on recognizing early signs of mental distress and chronic illnesses, particularly in vulnerable populations.

Key Takeaways:

Suicide is now the leading cause of unnatural death among life insurance claims.

Mental health challenges, compounded by financial stress, are hitting older adults hardest.

Cancer remains the top health threat, especially for women, underscoring the need for early screening.

Long-term disability and income protection are increasingly essential, especially with age.

Early intervention is crucial in preventing mental health crises.

This report shines a light not only on rising insurance claims but on the urgent need to address mental health stigma, increase early screening, and strengthen support systems across South Africa.

Original Source: [Discovery Life 2024 Claims Data]

Author: Nettalie Viljoen

Comments